Capitalism Fails? Wall Street Journal Columnist Rails Against Billionaires Evading Taxes #Political

The Wall Street Journal has promoted itself as the "Daily Diary of the American Dream," as a promoter of national prosperity. But some columnists find the titans of capitalism too unseemly to support any more.

The Journal’s "Heard on the Street" columnist Carol Ryan threw down the gauntlet against the “superwealthy” in her February 18 screed headlined, “Billionaires’ Low Taxes Are Becoming a Problem for the Economy.”

The Journal’s "Heard on the Street" columnist Carol Ryan threw down the gauntlet against the “superwealthy” in her February 18 screed headlined, “Billionaires’ Low Taxes Are Becoming a Problem for the Economy.”

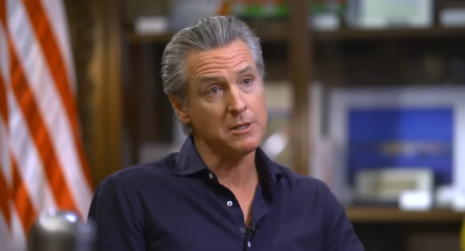

Ryan used California — yes, Gavin Newsom’s tax-worshipping California — as an example of a lefty-run state doing the brave thing by sticking it to the affluent, even if the method is flawed. “California’s plan to hit its richest residents with a one-off wealth tax is a long shot, and its design has problems,” Ryan began. “But a look at who picks up the tab when billionaires scrimp on taxes, and how wealth concentration is affecting the wider economy, shows why the issue isn’t going away.”

Ah, so California’s addressing the right problem but using a flawed mechanism to do it, eh? So do we just need to find out how to more efficiently raise taxes so the administrative framework is better? Good grief. Somebody want to page Lachlan Murdoch and tell him to go pick up his newspaper?

Ryan highlighted how “California has the highest concentration of billionaires in the U.S. with 255 individuals, or slightly more than a fifth of the country’s billionaire population, data from wealth-intelligence firm Altrata shows.” But, of course, she underplayed the fact that billionaires are currently fleeing the state of California for states like Nevada and Florida precisely because the former isn’t satisfied with maintaining its top position as the state with the highest income tax rate (13.3 percent) as of 2025. And this is not even counting California’s outrageous sales and use tax rate range between 7.25 percent on the low end and 11.25 percent on the high end.

Ryan selected as an expert Ray Madoff from Boston College, who loathes the wealthy enough to be featured on National Public Radio, talking about how all this unfairness creates an "appetite for change."

Technology firm Atom founder Zain Aziz told Business Insider February 8 that “[y]ou don't really want to get punished if you do good and you create more jobs." He continued, praising his new Nevada home: “I believe the Las Vegas Valley has become more and more what's synonymous with what California used to be — which was free-spirited and 'Come and achieve the impossible.’”

Apparently this was lost on Ryan, who fear-mongered that the “The risk is that the U.S. economy becomes increasingly dependent on a narrow group of very rich households, whose spending is tied to the performance of the stock market.” The only issues Ryan bothered pointing out with wealth taxes writ large is that they “are hard to administer, and the ultrarich can simply leave if they don’t like where a state’s tax policies are headed.” But she mentioned nothing about the complexities of appropriately evaluating an income-earner's assets (wealth) due to their inherently subjective nature to begin with.

It’s not until the 11th paragraph that Ryan concedes that the tax code may have something to do with why billionaires are able to capitalize on the benefits their armies of accountants rifle through on a routine basis. She cited and then dismissed the fact that the top earners in the U.S. pay 40 percent of federal income taxes while another 40 percent of Americans in lower brackets pay nothing. It doesn't matter because “billionaires aren’t captured by this picture because most of their wealth lies outside the income-tax system.”

But if top earners are still paying the vast amount of income taxes anyway with a complicated tax code while the bottom 40 percent are paying nothing, then how is this dramatic tax evasion? She didn’t mention that California alone has a whopping 2,910 pages in its 2025 tax code, separate from the over 6,000 pages that make up the federal tax code. That means Californians are stuck facing around a daunting 8,910 pages of tax code on an annual basis, and Ryan appears to be arguing that complicating it further with a stupid wealth tax is somehow meritorious in its intent if overtly flawed in its “design.”

The Tax Foundation released a study in 2024 finding that many “Wealth taxes disincentivize entrepreneurship, leading to less innovation and less long-term growth. A wealth tax reduces wages, destroys jobs, and reduces the stock of capital. All income groups are worse off under a wealth tax due to decreased economic activity.” One would think Ryan would consider that billionaires leaving California because of the risk of complicating an already complex tax code is proof in the pudding of the Tax Foundation’s thesis. But alas, she was rooting for the Left to win with their "populist measures" to tax the rich.

But the very fact of the rising concentration of wealth in the hands of the superwealthy means the issue of how to tax it won’t be going away, and pressure could build for ever-more populist measures, including at the national level.

Pathetic.

from Newsbusters - Welcome to NewsBusters, a project of the Media Research Center (MRC), America’s leading media watchdog in documenting, exposing Follow News Busters

Red Pill Pharma A psychological pharmaceutical that unlocks logic and reason offering a second chance at individualism.

Sourced by the Find us on telegram. Real News for Patriots of the United States of America. We share content that re-affirms our soulful connection to light, Truth, and the Constitutional God given rights of Freedom and Liberty.

No comments